FirstEnergy Pennsylvania Will File Rate Review to Support Continued Service Reliability Enhancements for Customers

Company Continues Efforts to Keep Costs Manageable for CustomersREADING, Pa., April 2, 2024 -- FirstEnergy Pennsylvania (FE PA), a subsidiary of FirstEnergy Corp. (NYSE: FE) doing business as Met-Ed, Penn Power, Penelec and West Penn Power, will request today a review of its base electric rates by the Pennsylvania Public Utility Commission (PUC). The proposed rate adjustment builds on service reliability enhancements made in recent years by upgrading additional distribution grid equipment, providing ongoing tree trimming with a focus on off-right-of-way trees and creating a dedicated team to help low-income residential customers participate in bill assistance programs.

The rate proposal is designed to benefit more than two million customers by continuing FE PA's work to reduce or minimize outages throughout its service territory and enhancing key services. Highlights of the rate review proposal include:

- Modernizing the grid with automated technologies that can prevent or reduce the scope and duration of power outages.

- Increasing the frequency of inspections of overhead circuits and transformers to identify and replace aging equipment.

- Converting about 85,000 company-owned streetlights to energy-efficient LED streetlights that save electricity and money.

- Removing more than 2.4 million trees and overhanging limbs that pose a threat to damage poles and wires along 14,000 miles of line, both on and around power line corridors, over the next 10 years to help reduce tree-related electric service interruptions. Off-right-of-way trees are responsible for more than 90% of tree-caused service interruptions.

- Creating an Energy Assistance Outreach Team to increase awareness and participation in energy assistance programs available to low-income customers.

- Eliminating service fees for customers to pay their electric bills by credit card; benchmarking and customer surveys found 45 percent of customers would pay by credit card if there were no fees.

- Creating an electric vehicle (EV) pilot program to encourage customers to purchase EVs by providing rebates for licensed electricians to install home chargers and other incentives.

Scott Wyman, President of FirstEnergy's Pennsylvania Operations: "Continued investments in a smart, modern energy grid coupled with an expanded vegetation management program that targets trees threatening our equipment will help us deliver on our commitment to providing dependable electricity to homes, businesses and communities. The work we are doing makes a positive difference – installation of new equipment coupled with proactive tree trimming has helped reduce the frequency of electric service interruptions experienced by our Pennsylvania customers by 14 percent since 2019. This rate proposal balances the need to invest in the system while helping keep electric bills comparable to other utilities in the state."

FE PA's rate request totals $502 million across its four Pennsylvania rate districts. If approved, monthly bills would increase on average in the range of $16.61 to $21.30 or about 9.2% to 11.8% for a typical FE PA residential customer using 1,000 kilowatt-hours (kWh) per month. The average monthly bill for FE PA customers would be in line with the statewide average for typical customers served by the other three major electric utilities in Pennsylvania.

FE PA last filed a Pennsylvania rate review in 2016 with rates taking effect in January 2017.

Specific rate review impacts of the current filing are as follows:

- Met-Ed has requested an increase of $146 million. If approved, the total bill for the typical residential customer using 1,000 kWh per month would increase 9.2% or $17.31 for a new monthly total bill of $205. The bill for a commercial customer using 40 kilowatts (KW) for 250 hours would increase 3.9% or $57.61 for a total bill of $1,523.59. The bill for an industrial customer using 20 megawatts (MW) for 474 hours would increase by 0.5% or $4,958.02 for a total bill of $922,490.44.

- Penelec has requested an increase of $132 million. If approved, the total bill for the typical residential customer using 1,000 kWh per month would increase 9.8% or $19.79 for a new monthly total bill of $220.75. The bill for a commercial customer using 40 KW for 250 hours would increase 4.4% or $66.52 for a total bill of $1,576.49. The bill for an industrial customer using 20 MW for 474 hours would increase by 1.8% or $9,806.10 for a total bill of $558,069.72.

- Penn Power has requested an increase of $55 million. If approved, the total bill for the typical residential customer using 1,000 kWh per month would increase 11.8% or $21.30 for a new monthly total bill of $201.88. The bill for a commercial customer using 40 KW for 250 hours would increase 4.1% or $61.05 for a total bill of $1,549.85. The bill for an industrial customer using 20 MW for 474 hours would increase by 0.7% or $2,764.34 for a total bill of $373,144.37.

- West Penn has requested an increase of $169 million. If approved, the total bill for the typical residential customer using 1,000 kWh per month would increase 10.6% or $16.61 for a new monthly total bill of $172.98. The bill for a commercial customer using 40 KW for 250 hours would increase 4.6% or $61.03 for a total bill of $1,374.25. The bill for an industrial customer using 20 MW for 474 hours would increase by 0.3% or $1,917.74 for a total bill of $642,064.14.

Pending PUC approval, FE PA has requested that the new rates take effect on June 1, 2024. For more information about the proposed rate plan, customers may call the company at 1-800-545-7741.

Met-Ed, Penelec, Penn Power and West Penn Power continue efforts to keep costs manageable for customers. To help customers manage their bills, average payment plans, special payment plans and access to energy assistance programs are offered. For more information, please visit www.firstenergycorp.com/billassist. To learn more about energy efficiency products and programs to help save money, visit www.energysavepa.com.

The public is invited to comment on the filing through the PUC's public comment process and FE PA will participate in public meetings about the plan and engage key stakeholders to ensure an open and thorough review of the proposal.

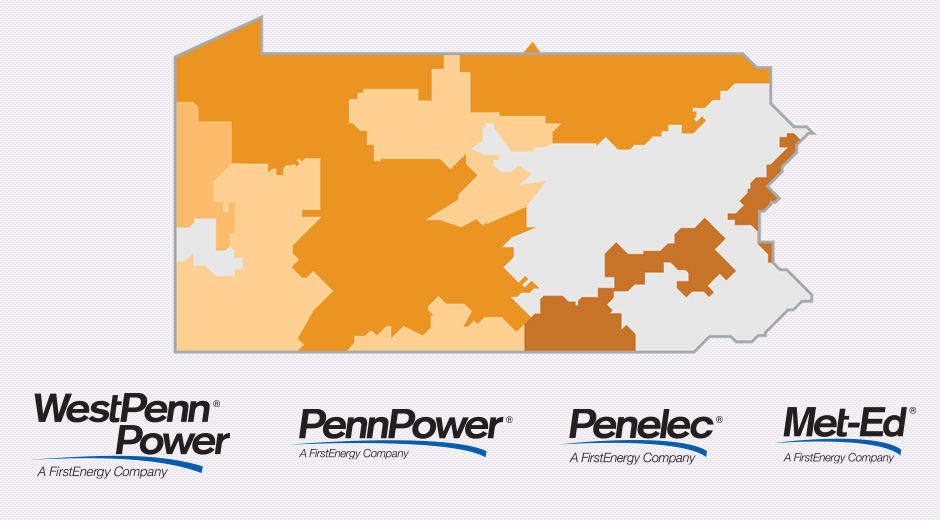

Met-Ed serves approximately 592,000 customers within 3,300 square miles of eastern and southeastern Pennsylvania. Follow Met-Ed on X, formerly known as Twitter, @Met Ed and on Facebook at www.facebook.com/MetEdElectric.

Penelec serves approximately 597,000 customers within 17,600 square miles of northern and central Pennsylvania and western New York. Follow Penelec on X @Penelec and on Facebook at facebook.com/PenelecElectric.

Penn Power serves approximately 173,000 customers in all or parts of Allegheny, Beaver, Butler, Crawford, Lawrence and Mercer counties in western Pennsylvania. Follow Penn Power on X @Penn_Power, on Facebook at www.facebook.com/PennPower, and online at www.pennpower.com.

West Penn Power serves approximately 746,000 customers in 24 counties within central and southwestern Pennsylvania. Follow West Penn on X @W_Penn_Power and on Facebook at facebook.com/WestPennPower.

FirstEnergy is dedicated to integrity, safety, reliability and operational excellence. Its electric distribution companies form one of the nation's largest investor-owned electric systems, serving customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York. The company's transmission subsidiaries operate approximately 24,000 miles of transmission lines that connect the Midwest and Mid-Atlantic regions. Follow FirstEnergy online at www.firstenergycorp.com and on X @FirstEnergyCorp.

Forward-Looking Statements: This news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms "anticipate," "potential," "expect," "forecast," "target," "will," "intend," "believe," "project," "estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney's Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio's 133rd General Assembly ("HB 6") and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, rising interest rates, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cyber security, and climate change; the risks associated with physical attacks, such as acts of war, terrorism, sabotage or other acts of violence, and cyber-attacks and other disruptions to our, or our vendors', information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to meet our goals relating to employee, environmental, social and corporate governance opportunities, improvements, and efficiencies, including our greenhouse gas ("GHG") reduction goals; the ability to accomplish or realize anticipated benefits through establishing a culture of continuous improvement and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our Energize 365 transmission and distribution investment plan, executing on our rate filing strategy, controlling costs, improving our credit metrics, growing earnings and strengthening our balance sheet; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including but not limited to those related to climate change; changes in customers' demand for power, including but not limited to, economic conditions, the impact of climate change, emerging technology, particularly with respect to electrification, energy storage and distributed sources of generation; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; future actions taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission ("SEC") filings. Dividends declared from time to time on FirstEnergy Corp.'s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.'s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.'s (a) Item 1A. Risk Factors, (b) Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and (c) other factors discussed herein and in FirstEnergy's other filings with the SEC. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.'s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise.

News Media Contact: Todd Meyers, (724) 838-6650; Investor Contact: Irene Prezelj, (330) 384-3859